CBN MEMBER BRIGHT SPOTS

Moving Money to Mission Through Impact Investing Partnerships with CDFIs

This story was originally published on the Philanthropy Missouri blog as a guest post by Paula Langley, Senior Project Manager, IFF & Gary Newcomer, Director of Operations, Community Builders Network (on behalf of the St. Louis CDFI Coalition)

Members of the St. Louis Coalition at the St. Louis CDFI Forum hosted by the Federal Reserve

The St. Louis CDFI Coalition is a partnership among eight Community Development Financial Institutions (CDFIs) that offer an array of capital, development, and consulting services and share a common mission to empower a comprehensively healthy St. Louis community through support for nonprofits, small businesses, and communities facing disinvestment.

CDFIs, which are designated by the U.S. Department of the Treasury, provide financial services to borrowers where commercial banks and traditional lenders leave gaps. Some specialize in midsize to large loans to community-serving agencies; others provide small, individual loans and other credit and financial services, while others focus on small business and real estate development lending.

The eight CDFIs in the St. Louis Coalition share a common mission of access to safe and affordable financial products and services, and offer mission-driven loans and other resources that are more flexible and accessible than traditional financing. Loans and resources are deployed across the region into some of St. Louis’ most economically distressed communities, and members frequently re-assess needs and look for innovative ways to fill financial gaps.

The St. Louis CDFI Coalition in Action

The St. Louis CDFI Coalition is a diverse collection of community development organizations ranging from depositories to loan funds and has supported a range of work including the highlighted projects below:

Justine PETERSEN was profiled by the Wall Street Journal for their work supporting black-owned businesses through the Paycheck Protection Program (PPP).

St. Louis Community Credit Union created gateways to banking careers.

Gateway CDFI financed affordable homes in North St. Louis neighborhoods.

IFF supported the early childhood education (ECE) community through Urban Sprouts Development Center.

Alltru Credit Union fought for the financial health of the community.

The International Institute Community Development Corporation provided business development support to refugees that launched a local soap business.

Rise CDFI is rolling out its minority contractor and small developer loan funds in 2021.

Alliance Credit Union is a Low-Income Designated CDFI with strong consumer, mortgage, and commercial lending portfolios.

To read more stories about CDFIs, look to the St. Louis CDFI Coalition blog. Elsewhere in Missouri, there are CDFIs Coalitions such as the Kansas City CDFI Coalition, including statewide CDFIs Gateway, IFF, and Justine PETERSEN. For a full list of CDFIs, see Opportunity Finance Network’s CDFI Locator.

Invest in CDFIs

Impact investing in CDFIs is an additional way for investors and funders who are looking to amplify their social impact while also gaining financial returns. IFF’s CEO, Joe Neri, recently shared the benefit of partnering with CDFIs to achieve a social mission and stated, “those investments can also strengthen the entire community finance ecosystem and, in turn, create greater impact in even more communities”. Impact investors and CDFIs can partner together to amplify shared missions of social impact that ultimately strengthen the entire community finance ecosystem.

If you or someone you know is interested in learning more about CDFIs, impact investing, and how to invest in your local St. Louis CDFI community, please visit our website to learn more about each CDFI’s mission and how to invest. For more information on how to support the St. Louis CDFI Coalition, reach out to Gary Newcomer at gary@communitybuildersstl.org.

To view the original blog post, click here.

CBN Members Spotlighted in Article About STL's North Central Corridor

New plans on redeveloping The North Central Corridor that will bring the Delmar Divide together. Including many of our CBN members getting active in creating a community plan.

Beyond Housing Launches Once and For All Effort

President and CEO of Beyond Housing Chris Krehmeyer launches Once and For All, to combat underlying problems in St. Louis. The plan is to bring awareness to poverty using the hashtag “Dear Lou”.

Justine PETERSEN Impact Page and Shop Local Tool

Justine PETERSEN introduces a search bar of locally owned business in the St. Louis area! The JP tool includes of minority and female owned business. As well as a map to navigate all the wonderful clients and companies! The map ties into an impact sheet of transparency and growth.

Prosperity Connection Announces Kathy Siddens as New Executive Director

Prosperity Connection has chosen Kathy Siddens as the organization’s new Executive Director. After searching for almost a year, it was decided Kathy was a great fit thanks to her outstanding work in the financial service industry and support of financial wellness throughout St. Louis.

SLACO Working to Register and Educate Voters

The St. Louis Association of Organizations (SLACO) was out in neighborhoods educating new voters in St. Louis for the upcoming April election. So far SLACO has registered 25 voters and continue to do outreach via social media.

Prosperity Connection Series- Black Finance Professionals

Monica Campbell, Vice President, Community Development at Enterprise Bank and Trust was featured in the Prosperity Connection Series Black Finance Professionals , where she explains how her career started.

DeSales Young Ambassadors team up with Landmarks Urbanites on "Heart Bombing" Event

On Saturday, February 13th, DeSales Young Ambassadors teamed up with the Landmarks Urbanites to throw a "heart bombing" event! The weather could not have been worse, but lots of dedicated STL lovers still showed up! The purpose of the event was to bring attention to significant buildings and neighborhoods which needed some attention and investment.

North County Inc. Seeks Award Nominations for Annual Leadership Celebration

North County will be hosting their Annual Leadership Breakfast September, 17th from 7:30am-9:30am! The celebration will take place at the Marriott St. Louis Airport and showcase individuals and organizations that have impacted North County through the following area’s: exemplary business, civic and community leadership. To nominate worthy candidates click here. Nominations are due April 9th!

Rise New Executive Director Terrell Carter

St. Louis nonprofit Rise Community Development has named a new executive director to replace Stephen Acree, who has plans to retire this summer. A St. Louis native, that is passionate about making the St. Louis community equitable!

IISTL names Arrey Obenson as new President and Chief Executive Officer

February marked the beginning of a new strategy for the International Institute as Arrey Obenson began his position as the President and Chief Executive Officer. Prior to that, Anna Crosslin had led the organization since 1978. Obenson comes to the position after serving as co-founder and CEO of Transformunity. Before that, he was the Secretary General of Junior Chamber International (JCI). It was his work at JCI that brought him to St. Louis from Cameroon in 2002.

CBN members who were awarded AHTF funding

Last month, it was announced that seven CBN members were awarded funds through the Affordable Housing Trust Fund's Fall 2020 funding cycle! These awards will support a variety of projects throughout the City over the coming year.

SLDC Planning an Internal Reorganization to Focus on Neighborhoods

St. Louis is taking charge in redeveloping neighborhood by neighborhood! Targeting areas like the North and South side of St. Louis City. Talk about a positive shift of traditional structures!

NewCities Team Up with St. Louis Development Corporation to present St. Louis as a New Urban Champion

The New Urban Champions initiative gives St. Louis a voice to share many stories revolving around systemic issues in urban planning and equity. Building a community of collaboration and finding solutions should highlight consistent growth within St. Louis as well as improve the quality living!

Rachel Witt of South Grand published on Engaging Local Government Leaders blog

Executive Director Rachel Witt of South Grand Community Improvement District writes a compelling article on producing a successful outcome of special taxing districts. Diving into what a community infrastructure truly consist of!

Read full story here

PHOTO CREDIT BY SOUTH GRAND COMMUNITY IMPROVEMENT DISTRICT

Regional Response Team COVID-19 Response

The Regional Response Team is out in the community to inform and strengthen populations that have been affected by COVID-19. While trying to prevent inequalities that arise! The Regional Response team is also advising Greater St. Louis to continue with safety precautions like wearing a mask, washing hands, and social distancing! COVID-19 Regional Response Team (RRT) guides!

Photo Credit Regional Response Team

Justine PETERSEN Profiled by Wall Street Journal for PPP Lending

Many small businesses across the country are struggling to make ends meet in the wake of COVID-19, and the St. Louis region is no exception.

To meet the need, Justine PETERSEN stepped up as a Paycheck Protection Program (PPP) lender to support small businesses in the St. Louis area who might not have connections with traditional banks. The Wall Street Journal recently took notice of how Justine PETERSEN is doubling down on their commitment to support small businesses in 2021.

Rebecca Mawuenyega of Dellwood Pharmacy was one of those businesses in the St. Louis area struggling to recover from the COVID-19 pandemic. Her business benefitted from PPP lending at Justine PETERSEN after losing more than 40% of her revenue. Her business was able to receive $16,000 through the program at a critical time and is pursuing PPP lending for a second time due to recent increases in local COVID cases.

“Because the COVID numbers are going up, it’s happening again.”

-Rebecca Mawuenyega

The PPP loan made possible through Justine Petersen helped Dellwood Pharmacy to keep her business open and serving the local community.

And her business isn’t the only one benefiting from the program.

“There seems to be a healthy demand” said Galen Gondolfi, Chief Communications Officer at Justine PETERSEN. In the first week, they received about 150 inquiries from small businesses asking about the PPP program.

Rebecca Mawuenyega of Dellwood Pharmacy

Moreover, Justine PETERSEN has been tracking where their PPP lending is going. 75% of the $14.8 million in their PPP lending went to BIPOC-owned small businesses, which were much less likely to access PPP lending during the first round of the federal stimulus program.

Justine Petersen’s mission is to connect institutional resources with the needs of low- to moderate-income individuals and families, helping them to build assets and create enduring change - not just for each individual or family that they assist, but the community as a whole.

Justine PETERSEN is a member of the St. Louis CDFI Coalition, a partnership among eight CDFIs that offer an array of capital, development, and consulting services and share a common mission to empower a comprehensively healthy St. Louis community through support for nonprofits, small businesses, and communities facing disinvestment.

All photos from this story taken by Rebecca Mawuenyega. Read the full story from the Wall Street Journal here.

St. Louis Community Credit Union Creates Gateways to Banking Careers

St. Louis Community Credit Union is more than a credit union. They’re a leader and voice for social justice in the financial services world and across St. Louis neighborhoods. They exist to increase the standard of living and better the lifestyle of their members, staff, and the communities they serve.

That’s why they decided to co-found the Gateway to a Banking Career program in 2018 with Carrollton Bank and Enterprise Bank & Trust to create more equitable access to careers in the financial sector.

The Gateway to a Banking Career program has two goals:

Offer individuals a pathway to career options within the financial services industry

Build a more inclusive and diverse workforce within banks and credit unions

Since launching, four cohorts and a total of 46 people have successfully completed the program. Of those who completed the program, 42 self-identify as African American (35), Latino (2), or immigrants (5) to the United States.

Participants learn how to pursue a successful career in the financial services industry. Training covers essential elements like customer service best practices, banking products and services, personal financial wellness, resume writing, business etiquette, and interview skills.

“Not only did this program get me ready for the Credit Union professionally, but also gave me a boost of confidence with my personal goals. I was made aware that there’s no limit to my talent, and all I had to do was show up and show out!

Tammerah J.

2018 Gateway to a Banking Career Participant”

Everyone who successfully completes their two-week training receives a stipend, guaranteed job interview with at least one of the participating financial institutions, and ongoing encouragement post-program. To date,19 participants secured employment at a financial institution, while numerous others were able to secure employment opportunities at other employers.

Banks and credit unions do not traditionally partner to produce joint programming, much less develop a job training program. However, St. Louis Community Credit Union, Carrollton Bank, and Enterprise Bank & Trust shared a common commitment to building a diverse and inclusive financial workforce and have long-standing relationships.

“Not only did this program get me ready for the Credit Union professionally, but also gave me a boost of confidence with my personal goals. I was made aware that there’s no limit to my talent, and all I had to do was show up and show out!” said Tammerah J., participant in the 2018 Gateway to a Banking Career program.

St. Louis Community Credit Union partners with Employment Connection, Connection to Success, and the International Institute, among others, in order to connect area residents to the program and opportunities in banking careers.

When the COVID-19 pandemic hit St. Louis, the Gateway to a Banking Career program transitioned to a virtual format!

St. Louis Community Credit Union is a certified community development financial institution (CDFI). Through caring service and education, St. Louis Community Credit Union provides the residents of the St. Louis region with safe, affordable and accessible financial services and products. For more than 75 years and counting, they have been serving residents of St. Louis City and those of Franklin, St. Louis and St. Charles counties in Missouri; as well as St. Clair, Madison, Monroe and Jersey counties in Illinois.

St. Louis Community Credit Union is a Low-Income Designated credit union and is one of the largest Minority Depository Institutions in the United States (per the National Credit Union Administration).

St. Louis Community Credit Union is a member of the St. Louis CDFI Coalition, a partnership among eight CDFIs that offer an array of capital, development, and consulting services and share a common mission to empower a comprehensively healthy St. Louis community through support for nonprofits, small businesses, and communities facing disinvestment.

North County Inc. Shares 2020 Year-End Wrap-Up

Screenshot from NCI’s 2020 Year-End Wrap-Up

To celebrate the new year, North County Inc. put together a wrap-up of their progress and accomplishments over the course of 2020. Read on to learn more about how NCI helped support the region’s COVID-19 response, advocated for important funding and policy changes, shared stories about the great work happening in North County, and more.

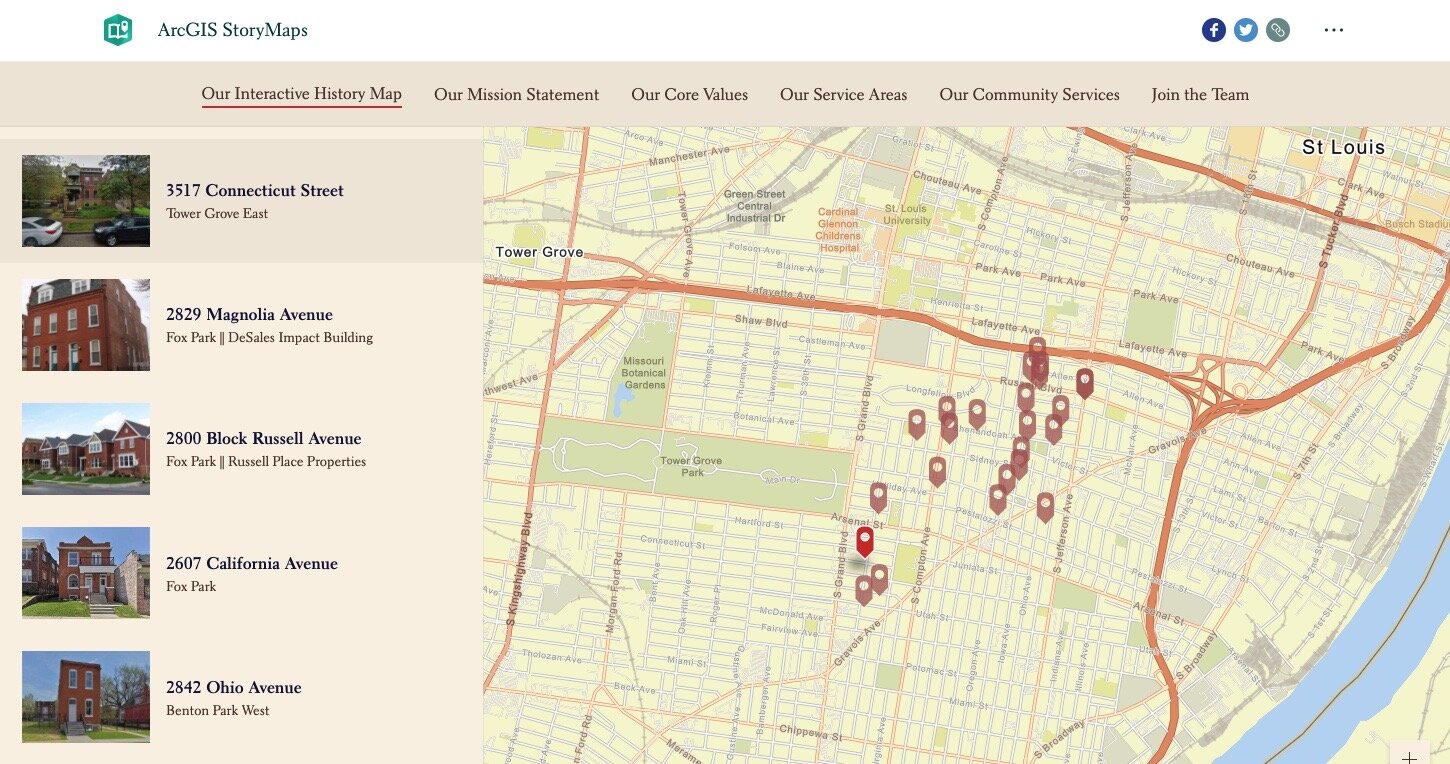

DeSales Community Development Completes Interactive History Map

DeSales Community Development has been working on a mapping platform to communicate the development and community work that’s been done in their service area neighborhoods. This map showcases the people, companies, and organizations that have helped to make the communities they serve a thriving piece of South St. Louis City.

Screenshot from DeSales Community Development’s interactive map