Community Development at Work: The St. Louis CDFI Coalition

The St. Louis CDFI Coalition: Investing for Equity

St. Louis CDFI Coalition member organization representatives

Community Development Financial Institutions (CDFIs) were created by the Department of the Treasury to serve communities that traditional financial institutions overlook. Mission-driven and financially flexible, CDFIs invest in communities with low incomes, the nonprofits that serve them, and small business entrepreneurs.

Many associate CDFIs with client-specific financial services, but CDFIs also help entire communities thrive with investments that expand access to opportunity. Local CDFIs have been key to connecting St. Louis’ underserved communities to critical resources, including healthcare, healthy foods, quality education, and affordable homes.

The St. Louis CDFI Coalition was formed in 2015 to help build a more equitable St. Louis through deep, creative systems-level investments. More specifically, the Coalition seeks to address the Ferguson Commission Report’s Calls to Action, which outlined greater investment in local CDFIs as a critical strategy to advancing racial equity in the region. The Coalition’s current members include Alliance Credit Union, Gateway CDFI, IFF, International Institute CDC, Justine Petersen, and St. Louis Community Credit Union, with two new organizational members expected in 2018.

The Coalition’s micro-lenders offer critical capital to growing small businesses in low-income and immigrant communities. The group’s real estate lenders support nonprofits and grocery stores and transform vacant buildings into affordable homes. Credit union members build wealth and credit for low-income individuals. Collectively, the Coalition’s work serves constituents on both an individual and collective level, from their most personal needs to the physical and economic infrastructures necessary to ensure their communities thrive.

CDFIs also invest in specific issue areas. For instance, IFF has managed two Healthy Food Financing Initiatives, designed to increase the financial resources and technical assistance available for businesses and nonprofits to open grocery stores in communities without fresh, healthy foods. Proactive investments like these fundamentally shift the feedback loop that governs a system’s rules and dynamics: they create jobs in economically distressed places, empower residents financially, and support better health outcomes for entire populations.

The CDFI Coalition believes that development for community benefit is a systemic effort, and that CDFIs can and must serve individuals and nonprofits while also investing in key elements that underpin the systems in which they live and operate. The Ferguson Commission Report calls for CDFIs and other community institutions to apply both approaches to push St. Louis toward a state of racial equity. The CDFI Coalition leverages the Report’s road map to guide its individual and collective investments and plans to continue deepening its engagement with the Calls to Action in 2018.

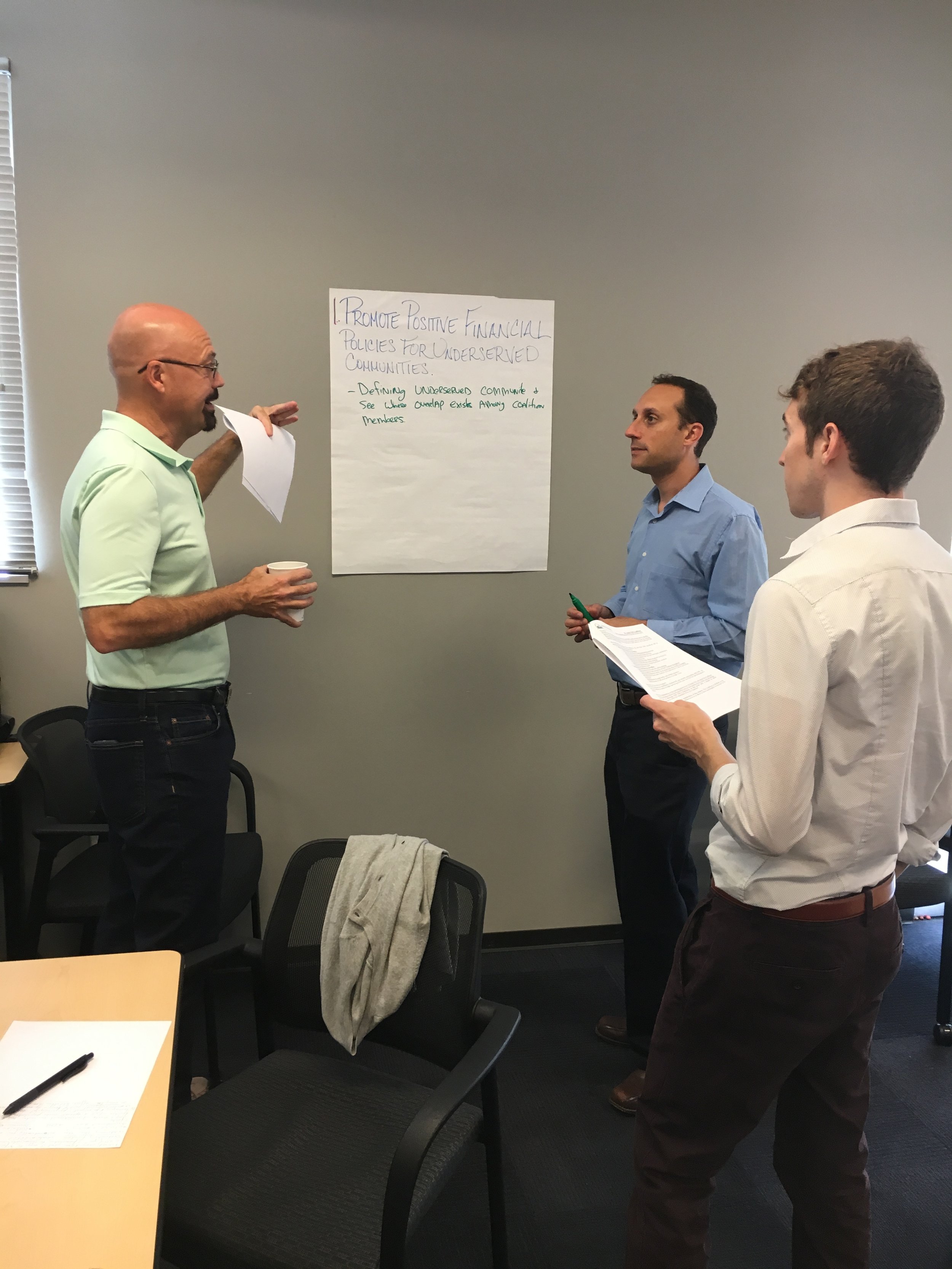

Below are photos from the CDFI Coalition’s strategic planning session in September 2017.

If you’d like to learn more about what the CDFI Coalition is doing, please feel free to reach out to one of the Coalition staff members or one of the member organizations below.

Coalition Staff

CBN

Gary Newcomer, Community Development Specialist

gary@communitybuildersstl.org

IFF

Breigh Montgomery, Associate

bmontgomery@iff.org

Member Organizations

Alliance Credit Union

Frank Evans, VP – Human Resources

fevans@alliancecu.com

Gateway CDFI

Colleen Hafner, Asset Manager

colleenhafner@slefi.com

IFF

David Desai-Ramirez, Executive Director – Southern Region

ddesairamirez@iff.org

International Institute CDC

Diego Abente, VP & Director

abented@iistl.org

Justine PETERSEN

Galen Gondolfi, Chief Communications Officer

ggondolfi@justinepetersen.org

St. Louis Community Credit Union

Maria Langston, AVP – Community Development

maria.langston@stlouiscommunity.com

Written by Breigh Montgomery, Associate at IFF